Today’s world is being fractured by an economic warfare over what kind of economic system it will have.

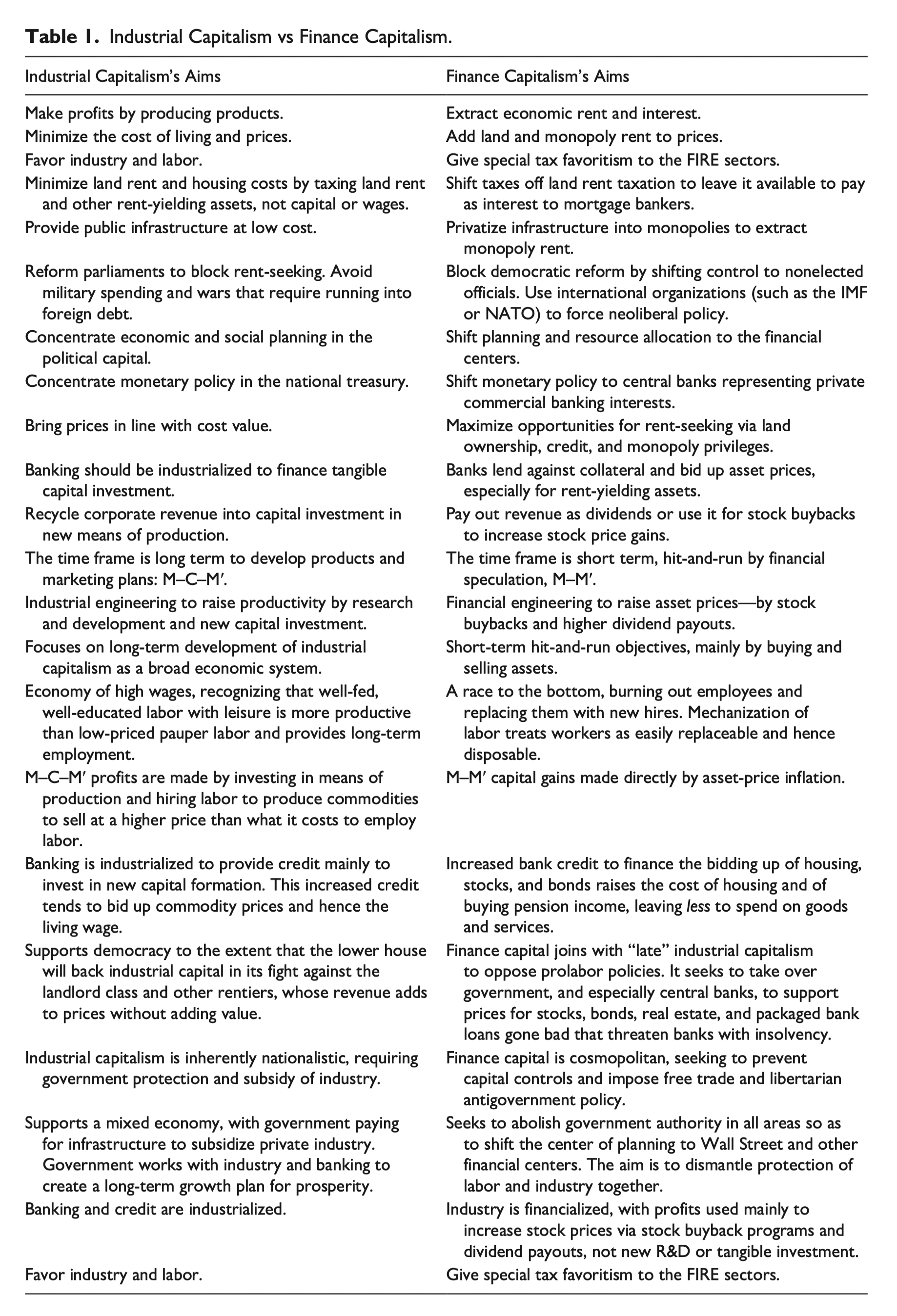

Industrial capitalism is losing the fight to finance capitalism, which has become industrial capitalism’s antithesis just as industrial capitalism was the antithesis to post-feudal landlordship and predatory banking houses (see table 1).

In this respect, today’s new Cold War is a conflict of economic systems. As such, it is being fought against the dynamic of US industrial capitalism as well as that of China and other economies. Thus, the struggle is domestic within the United States and Europe as well as confrontational against China, Russia, Iran, Cuba, and Venezuela and their moves to de-dollarize their economies and reject the Washington consensus and its dollar diplomacy. It is a fight by US-centered finance capital to promote neoliberal doctrine that gives special tax privileges to rentier income, untaxing land rent, natural resource rent, monopoly rent, and the financial sector. This aim includes privatizing and financializing basic infrastructure, thereby maximizing its extraction of economic rent instead of minimizing the cost of living and doing business.

The result is a war to change the character of capitalism as well as that of social democracy. The British Labour Party, European Social Democrats, and the US Democratic Party all have jumped on the neoliberal bandwagon. They are all complicit in the austerity that has spread from the Mediterranean to America’s midwestern rust belt.

Finance capitalism exploits labor but via a rentier sector that also ends up cannibalizing industrial capital. This drive has become internationalized into a fight against nations that restrict the predatory dynamics of finance capital seeking to privatize and dismantle government regulatory power. The new Cold War is not merely a war being waged by finance capitalism against socialism and public ownership of the means of production. In view of the inherent dynamics of industrial capitalism requiring strong state regulatory and taxing power to check the intrusiveness of finance capital, this postindustrial global conflict is between socialism—evolving out of industrial capitalism—and fascism, defined as a rentier reaction to mobilize government to roll back social democracy and restore control to the rentier financial and monopoly classes.

The old Cold War was a fight against communism. In addition to freeing itself from land rent, interest charges, and privately appropriated industrial profits, socialism favors labor’s fight for better wages and working conditions; better public investment in schools, health care, and other social welfare support; better job security; and unemployment insurance. All these reforms would cut into the profits of employers. Lower profits mean lower stock market prices and therefore fewer finance-capital gains.

The aim of finance capitalism is not to become a more productive economy by producing goods and selling them at a lower cost than competitors. What might appear at first sight to be international economic rivalry and jealousy between the United States and China is thus best seen as a fight between economic systems: that of finance capitalism versus that of a civilization trying to free itself from rentier privileges and submission to creditors through a more social philosophy of government empowered to check private interests when they act selfishly and injure society at large.

The enemy in this new Cold War is not merely socialist government but government itself, except to the extent that it can be brought under the control of high finance to promote the neo-liberal rentier agenda. The most blatant example is the Trans-Pacific Partnership’s proposal to create investor-state dispute settlement courts in which corporations can win compensation for profits that would be reduced by public laws enacted to prevent environmental pollution or consumer injury, with corporate-appointed judges empowered to set the compensation. This radical limitation on public lawmaking power reverses the democratic political revolution of the nineteenth century that replaced the House of Lords and other upper houses controlled by the hereditary aristocracy with more representative legislators.

Behind corporations stand their creditors seeking to free them from any public regulations that would impair corporate profits and hence ability to sustain debt service. The implicit aim is to create a corporate state, replacing elected houses of government with central banks—the US Federal Reserve and the European Central Bank—along with external pressure from the International Monetary Fund and World Bank.

The result is a cosmopolitan financial oligarchy. That shift of economic planning and regulation to the rentier financial and monopoly classes reverses democratic government power.

Lacking foreign affluence, the US corporate state promotes employment by a military buildup and public infrastructure spending, most of which is turned over to insiders to privatize into rent-seeking monopolies and sinecures. In the United States, the military is being privatized to fight abroad (e.g., Academi née Blackwater USA), and jails are being turned into profit centers using inexpensive convict labor.

What is ironic is that although China is seeking to decouple from Western finance capitalism, it actually has been doing what the United States did in its industrial takeoff in the late nineteenth century and early twentieth. As a socialist economy, China has aimed at what industrial capitalism was expected to achieve: freeing its economy from rentier income (landlordship and usurious banking), largely by a progressive income tax policy falling mainly on rentier income.

Above all, China has kept banking in the public domain. Keeping money and credit creation public instead of privatizing it is the most important step to keep down the cost of living and business. China has been able to avoid a debt crisis by forgiving debts instead of closing down indebted enterprises deemed to be in the public interest. In these respects, it is socialist China that is achieving the outcome that industrial capitalism initially was expected to achieve in the West.

Finance Capital as Rent-Seeking

The transformation of academic economic theory under today’s finance capitalism has reversed the progressive and indeed radical thrust of the classical political economy that evolved into Marxism. Post-classical theory depicts the financial and other rentier sectors as an intrinsic part of the industrial economy. Today’s national income and GDP accounting formats are compiled in keeping with this anti-classical reaction depicting the FIRE sector and its allied rent-seeking sectors as an addition to national income, not a subtrahend. Interest, rents, and monopoly prices all are counted as earnings—as if all income is earned as intrinsic parts of industrial capitalism, not predatory extraction as overhead property and financial claims.

This position is the opposite of classical economics. Finance capitalism is a drive to avoid what Marx and indeed the majority of his contemporaries expected: that industrial capitalism would evolve toward socialism, peacefully or otherwise. As Assa (2017) and Assa and Kvangraven (2021) described in detail, the change is the product of decades of lobbyists fighting to transform GDP statistics to describe banks’ penalty fees and indeed, any and all corporate revenue as a contribution to GDP, not as a cost. The result has been a transformation of the early GDP accounting format to a travesty that credits the financial sector as producing a product, not as imposing zero-sum transfer payments, as was formerly the case (Appelbaum and Batt 2014). █

Hudson expands on his ideas on finance capitalism versus industrial capitalism in his 2022 book The Destination of Civilization.

Republished with permission from Michael Hudson’s 2021 paper entitled ‘Finance Capitalism versus Industrial Capitalism: The Rentier Resurgence and Takeover.’ Photo credit: Francesca.hyanna19 via WikiMedia Commons (CC BY-SA 4.0) & Chris Fore via WikiMedia Commons (CC BY 2.0).